AFRIDIG WALLETS

PAY.SIMPLE

Enabling simple mobile and web based payment solutions for businesses.

Our simple yet highly innovative payment solutions are built for entrepreneurs by entrepreneurs.

A FEW WAYS WE ARE DOING THINGS DIFFERENT…

OUR SOLUTIONS

With over 23 million users in South Africa alone, there is a very good chance that your customer is already on WhatsApp. Give your client the convenience of chatting and transacting through a single channel. Without ever leaving WhatsApp your customers can pay you, view their transaction history and send money to loved ones.

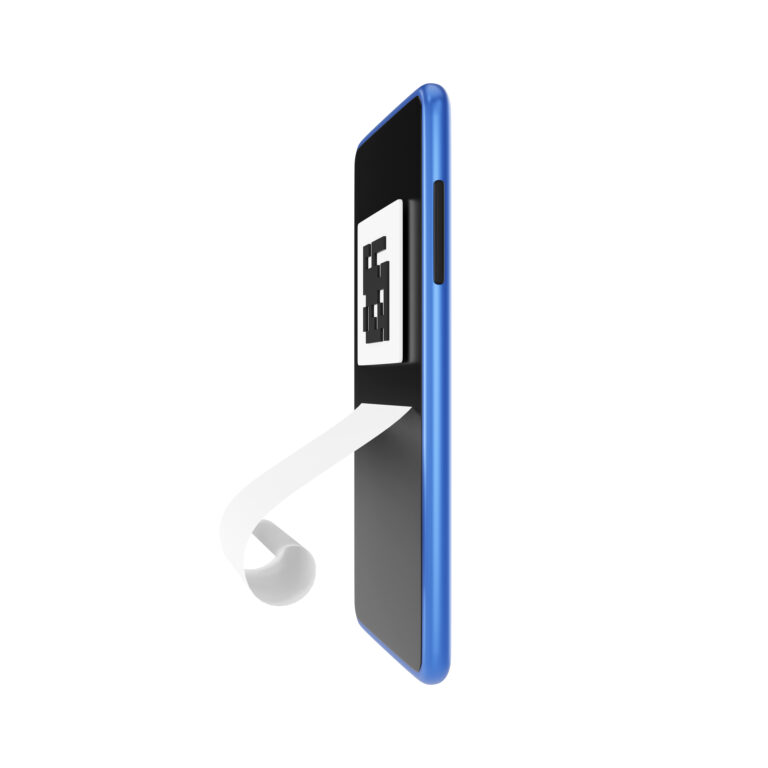

QR CODES

Simplify payments in your business by offering QR push and pull payments. No machines required.

FUNDS AVAILABLE IN REAL TIME

Why should you wait 24-48hrs before your card payments are settled into your account? Access funds in your merchant account at over 4000 Cash Express branded ATMs using cardless cash withdrawals. Receive payouts from your merchant account directly to your bank account within 24 hours.

VIRTUAL CARDS

Issue your customers with a prepaid Mastercard™ virtual card. Build customer loyalty by providing your customers with your own unique cash rewards programme.

SIMPLE SIGNUP

SPECIALISED SOLUTIONS

We developed Afridig wallets with three main features in mind.

Accessibility

Our wide range of partners means that you can top up or withdraw e-wallet funds conveniently!

- Almost any street corner

- Participating retailers

- Participating fuel stations

- Spaza shops

Acceptance

You can use the funds in your Afridig E-wallet to pay at many different places!

- Online shopping

- Participating major retailers

- Taxi rank traders

- Spaza shop ekasi

Convenience

We know how frustrating it is waiting in line to deposit money for your loved one, or to waiting at a retailer to withdraw a cashsend voucher!

- We are partnered with many different retailers, financial institutions & micro enterprises

- Multiple deposit & withdrawal channels

- Transfer money from your Afridig e-wallet to recipient using only recipient’s phone number

- Recipient does not need to be registered with Afridig

SERVICES

Our ScanAndPay product suite is revolutionary in its mobile first approach to card payments. With fixed transaction fees and immediate access to payments, ScanAndPay operates a host of extensive features that will change the way your business handles payments

DIGITAL WALLET

The ScanAndPay digital wallet is the ultimate payment acceptance tool for any small or medium sized business. Suitable for businesses that operate in low margin environments, the ScanAndPay digital wallet provides you with:

- Fixed, low transaction fees.

- The ScanAndPay chatbanking platform to access your Merchant account anywhere on the go and keep pulse of what is happening in your business directly on WhatsApp .

- A CRM web portal to manage all your business payments.

- QR codes to display in your business premises or share directly to your customer’s WhatsApp for a seamless payment experience.

TAP ON GLASS- MOBILE POS

Perfect for businesses that want to accept traditional card payments but without the inconveniences of inconsistent transaction fees, thermal rolls and card machines that become outdated and need to be replaced every few years.

The ScanAndPay mobile POS turns your NFC enabled cellphone into a point of sale capable of accepting payments without having to purchase or rent any additional hardware.

VIRTUAL CARD

Be at the forefront of change. Issue your clients with a virtual card from Mastercard™ that allows them to withdraw from over 4000 CASH EXPRESS ATM’s, scan to pay at stores and purchase from any online store that accepts major debit and credit cards. Virtual card use cases include;

- Virtual cards as a rewards or loyalty card for your customers. Encourage customers to pay using their digital wallet and pass on some of your savings on card transaction fees to your client as a cashback credited directly to their virtual card.

- Build customer loyalty through a virtual rewards programme.

- Generate virtual cards for your employees. As the business owner you have full view of all purchases and withdrawals made by your staff on the ScanAndPay web portal. Download reports directly from the web portal for reconciliation purposes.

FEES

We know that times are tough and business is slow, that is why we will never penalise you by making you pay more when your business is making less money. We charge you one simple and straightforward transaction fee for all your transactions. Whether you are receiving a R2000 payment or a R20 payment, our transaction fee remains fixed and constant.

DIGITAL WALLET

Transaction fees on the digital wallet are fixed at R2.00 per transaction.

web portal

Access to the web portal is FREE. Manage client profiles, management reports and employees directly from pur portal at ZERO cost.

Mobile pos

Transaction fees on the mobile POS are charged at the standard industry rate of 2.75% (excl VAT)

ATM WITHDRAWALS

Cardless cash withdrawals at Cash Express ATMs are charged at R10.00 per withdrawal.